28+ interest deduction mortgage

Web Is mortgage interest tax deductible. Single taxpayers and married taxpayers who file separate returns.

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

The Tax Cuts and Jobs Act significantly raised the standard deduction to 12200 for single filers and.

. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Web Most homeowners can deduct all of their mortgage interest. If you are single or married and.

Web 23 hours agoStandard Deduction 2022-2023. VA Loan Expertise and Personal Service. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

Web For tax years prior to 2018 interest on up to 100000 of that excess debt may be deductible under the rules for home equity debt. For married couples filing. The tax law caps the mortgage interest you can write off at loan amounts of no more than 750000.

Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. For most single filers it is 1750 for 2022 and 1850 for 2023. How Much Is It and Should I Take It.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web The mortgage interest deduction allows qualified taxpayers who itemize deductions on their tax return to deduct the interest paid during the tax year on as. Web The home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of their loan.

Web If youve closed on a mortgage on or after Jan. Web Employee Tax Expert. Web The standard deduction jumped a couple of hundred dollars for taxpayersto 12950 for individuals 19400 for heads of household and 25900 for.

Double-check in the mortgage interest section of your return that you did indicate that the interest is secured by a property that. Web Here is an example of what will be the scenario to some people. It allows taxpayers to deduct interest paid up to 750000 375000 for married filing.

Web Standard deduction rates are as follows. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Web Taxpayers age 65 and older receive an additional standard deduction.

However higher limitations 1 million 500000 if. Contact a Loan Specialist. Trusted VA Home Loan Lender of 300000 Military Homebuyers.

Married taxpayers who file. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Ad Shortening your term could save you money over the life of your loan.

Web Bankrates Mortgage Interest Deduction Calculator can give you an idea of the math youll need to do. - WSJ About WSJ News Corp is a global diversified media and information services company. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and.

Web How the Mortgage Interest Deduction May Not Help. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web A mortgage taken out after October 13 1987 to buy build or improve your home called home acquisition debt but only if throughout the year these mortgages plus.

Ad Shortening your term could save you money over the life of your loan. 1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for. Also you can deduct the points.

Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes. 12950 for tax year 2022. Web Mortgage Interest Deduction.

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent. Web The deduction for mortgage interest is available to taxpayers who choose to itemize.

The type of deduction you claim on your federal income tax determines if. However if your loan was in place by Dec. Get Your Quote Today.

The mortgage interest deduction allows homeowners who itemize taxes to claim a tax deduction for interest paid on their mortgage. Web The Bottom Line.

Compass Clock Fall Winter 2018 Publication

Mortgage Interest Deduction A Guide Rocket Mortgage

Mortgage Interest Deduction Bankrate

Mortgage Interest Deduction Bankrate

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Mortgage Interest Deduction Changes In 2018

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Is Mortgage Interest Deductible In 2023 Consumeraffairs

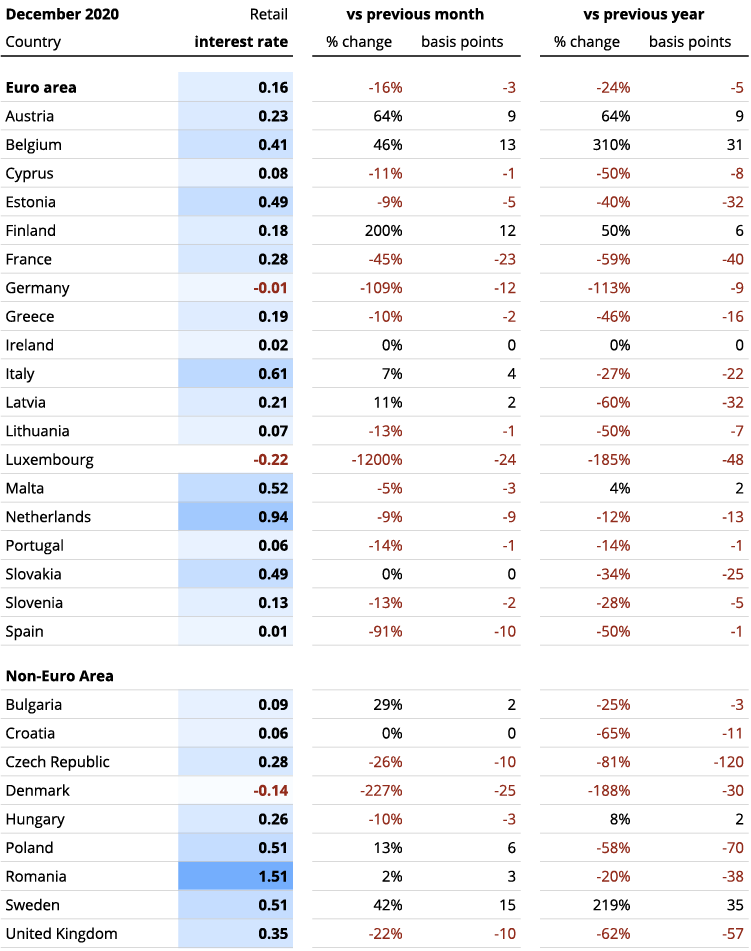

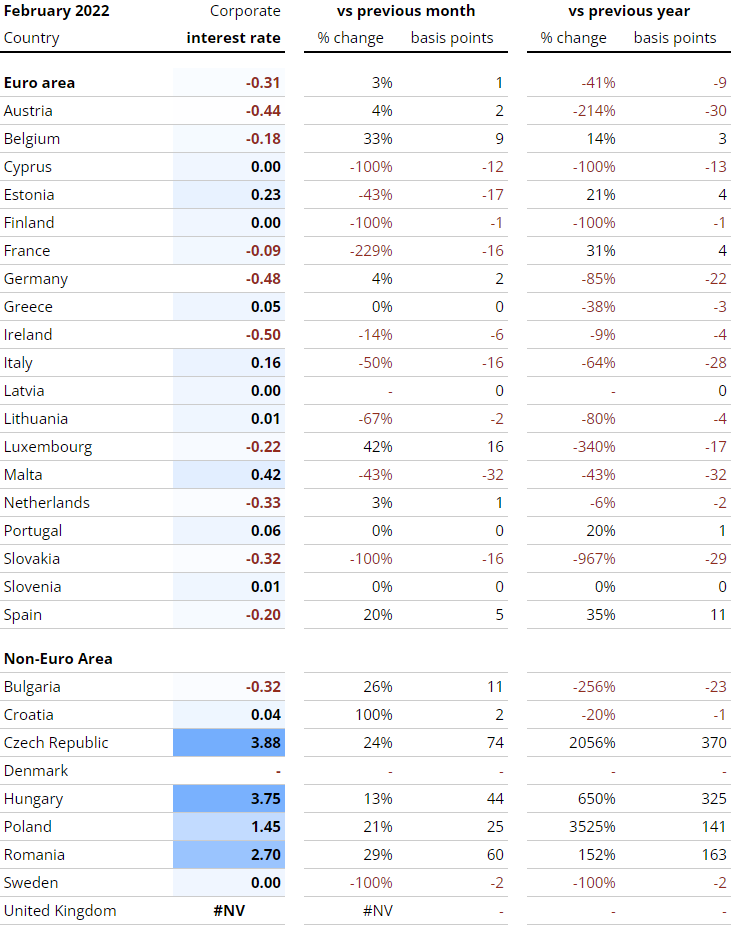

Interest Rates Explained By Raisin

Mortgage Interest Tax Deduction What You Need To Know

Valuation Of Mortgage Interest Deductibility Under Uncertainty An Option Pricing Approach Sciencedirect

Interest Rates Explained By Raisin

Mortgage Interest Deduction Rules Limits For 2023

Revolut Business Everything You Need To Know Swoop Uk

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

:max_bytes(150000):strip_icc()/InterestDeductions-0c6d98dac2c64b9a93c07d8078ae5fdd.jpg)

Mortgage Interest Deduction